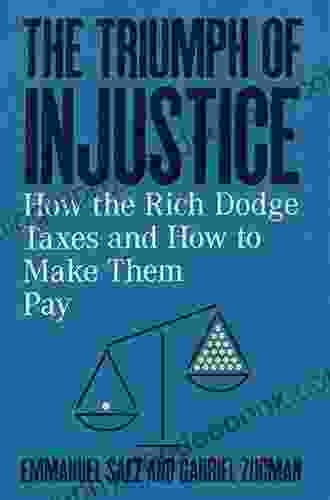

How the Ultra-Wealthy Dodge Taxes and What Can Be Done to Hold Them Accountable

Tax avoidance by the ultra-wealthy has become a pervasive problem, costing governments around the world billions of dollars in lost revenue. This article will shed light on the sophisticated methods used by the affluent to evade taxes, the impact of their actions, and potential solutions to address this issue.

4.5 out of 5

| Language | : | English |

| File size | : | 14625 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 241 pages |

Methods of Tax Avoidance

The ultra-wealthy employ a myriad of complex strategies to reduce their tax burden, including:

Shell Companies and Offshore Accounts:

They establish shell companies in tax havens with minimal regulations, which serve as conduits to conceal assets and income from tax authorities.

Trusts and Foundations:

Wealthy families create trusts and foundations to transfer assets to future generations and avoid estate taxes. These entities often operate under opaque regulations, making it challenging to trace the flow of funds.

Transfer Pricing:

Multinational corporations use transfer pricing to shift profits to subsidiaries in low-tax jurisdictions, reducing their overall tax liability.

Loopholes and Tax Havens:

The wealthy exploit loopholes in tax codes and take advantage of tax havens that offer preferential tax treatment, such as low or zero corporate tax rates.

Impact of Tax Avoidance

The consequences of tax avoidance by the ultra-wealthy are far-reaching:

Revenue Loss for Governments:

Lost tax revenue has severe implications for essential public services, such as healthcare, education, and infrastructure development.

Inequality and Social Justice:

Tax avoidance exacerbates income inequality, as the burden unfairly falls on middle-class and low-income earners. It also undermines public trust in the fairness of the tax system.

Economic Stagnation:

Lost revenue deprives governments of critical resources needed for economic growth and innovation.

Solutions to Address Tax Avoidance

Addressing tax avoidance requires multi-pronged efforts:

Tightening Tax Loopholes:

Governments must close loopholes in tax codes that allow the wealthy to exploit the system.

Increased Transparency and Regulation:

Enhanced transparency through mandatory disclosure of assets, trusts, and beneficial ownership information is crucial. Stricter regulations should apply to tax havens and shell companies.

International Cooperation and Data Sharing:

Collaboration among tax authorities worldwide can facilitate the exchange of information and prevent cross-border tax avoidance.

Progressive Taxation:

Consideration should be given to progressive tax systems that apply higher tax rates to higher incomes and wealth.

Public Awareness and Scrutiny:

Public awareness of tax avoidance practices can foster demand for accountability and motivate policymakers to take action.

Tax avoidance by the ultra-wealthy is a systemic issue that erodes public finances, undermines social justice, and hinders economic growth. It is imperative that governments, international organizations, and civil society collaborate to implement effective solutions. Closing loopholes, increasing transparency, promoting international cooperation, and fostering public awareness are crucial steps towards ensuring that the wealthy pay their fair share of taxes and contribute to a more just and equitable society.

4.5 out of 5

| Language | : | English |

| File size | : | 14625 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 241 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Page

Page Text

Text Story

Story Genre

Genre Reader

Reader Paperback

Paperback E-book

E-book Magazine

Magazine Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Foreword

Foreword Synopsis

Synopsis Footnote

Footnote Manuscript

Manuscript Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Autobiography

Autobiography Memoir

Memoir Reference

Reference Dictionary

Dictionary Narrator

Narrator Librarian

Librarian Archives

Archives Periodicals

Periodicals Research

Research Lending

Lending Reserve

Reserve Academic

Academic Journals

Journals Reading Room

Reading Room Rare Books

Rare Books Literacy

Literacy Thesis

Thesis Reading List

Reading List Book Club

Book Club Textbooks

Textbooks Jean Baxter

Jean Baxter A L Kaplan

A L Kaplan Chelsea Cain

Chelsea Cain James D Fry

James D Fry Keeanga Yamahtta Taylor

Keeanga Yamahtta Taylor Brent Tyman

Brent Tyman Daniel C Mattingly

Daniel C Mattingly Naomi Novik

Naomi Novik Jonathan Clements

Jonathan Clements May Nakamura

May Nakamura Kai Siedenburg

Kai Siedenburg David White

David White Laura Morelli

Laura Morelli Jordan Taylor

Jordan Taylor Richard Marcinko

Richard Marcinko Bryn Greenwood

Bryn Greenwood Kordel Lentine

Kordel Lentine Elizabeth Smith

Elizabeth Smith Hasbro

Hasbro Daniel Wendler

Daniel Wendler

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Eli BlairFollow ·4.1k

Eli BlairFollow ·4.1k Benji PowellFollow ·18.9k

Benji PowellFollow ·18.9k Mario SimmonsFollow ·17.4k

Mario SimmonsFollow ·17.4k Edgar Allan PoeFollow ·17.4k

Edgar Allan PoeFollow ·17.4k Dalton FosterFollow ·4.7k

Dalton FosterFollow ·4.7k Jarrett BlairFollow ·15.1k

Jarrett BlairFollow ·15.1k Tennessee WilliamsFollow ·18.7k

Tennessee WilliamsFollow ·18.7k Francisco CoxFollow ·7.1k

Francisco CoxFollow ·7.1k

Franklin Bell

Franklin BellSecond Edition Pdf No Audio: A Comprehensive Guide to the...

The Second Edition...

Jackson Blair

Jackson BlairTrends and Issues in Instructional Design and Technology

Instructional...

Mario Vargas Llosa

Mario Vargas LlosaEnchanting Enigma Variations and Triumphant Pomp and...

The Enigma Variations: A...

Dwight Blair

Dwight BlairTime Between Us: A Novel That Explores the Power of...

Prepare to be swept away by...

4.5 out of 5

| Language | : | English |

| File size | : | 14625 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 241 pages |